By Eileen Sepulveda

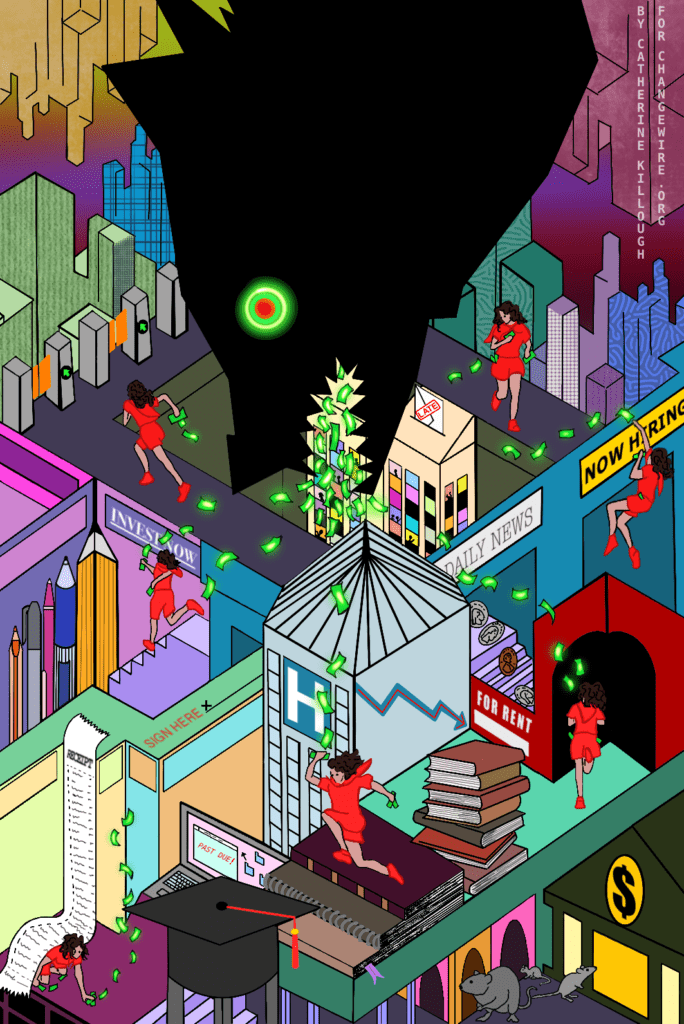

Come October, countless people look forward to the cool fall weather, changing leaves, cozy sweaters, and anything pumpkin-flavored. But I cannot ignore the looming reality of beginning to make payments on my student loans again this month.

A crushing decision

Like many Americans burdened by student loans, I had been watching and waiting anxiously as politicians and courts debated the fate of President Biden’s student debt forgiveness plans. The stakes were enormous. Our financial future – and the hope to finally be relieved of student debt – hung in the balance for millions of us.

For months, it felt like our fate was in the hands of just nine people as the Supreme Court weighed this all-important decision. In late June, the Supreme Court issued a ruling as many Americans were preparing for the holiday celebrating the independence of our country. For so many Americans, the ruling ended their hopes of being free from student loan debt.

The Court ruled (by a 6-3 vote) that Biden’s plan to forgive up to $20,000 of federal student loan debt per borrower wasn’t allowed by federal law. It was a crusade of lawsuits by corporations and their GOP knights in armor that won out over the will of the people. This decision was a painful blow for millions of Americans, including me.

Not all hope is lost

Shortly after the Supreme Court decision was released, the White House announced that the Department of Education had finalized plans for “the most affordable repayment plan ever created, called the Saving on a Valuable Education (SAVE) plan.”

The program aims to ease borrower stress by setting up economic payment plans for those who meet eligible income requirements. According to the White House statement, “This income-driven repayment plan will cut borrowers’ monthly payments in half, allow many borrowers to make $0 monthly payments, save all other borrowers at least $1,000 per year, and ensure borrowers don’t see their balances grow from unpaid interest.”

The Republicans tried to block this resolution, too. But President Biden has veto power over this attempt to stop any relief for low-income borrowers.

Still, many people like me are feeling increased anxiety as student loan payments are set to resume this month. More than half of those with student debt say they can’t afford both their loan payments and basic expenses, so they’ll need to choose between paying on their student debt and paying for rent or groceries.

A national issue with a personal impact

The reality is that Americans owe trillions in student debt. It’s a massive economic issue on a national scale — but for me, it’s very personal and has impacted my life in a significant way.

My student debt journey began more than a decade ago. In my adult years, I have always felt responsible for advocating for my community. So I decided to major in something I loved my entire life – writing. I hoped it would also give me a way to shed light on critical issues and make a difference. I also wanted to hone in on the natural gift I knew I possessed. However, that meant being financially prepared.

With my income from a full-time job and federal student aid, it still just wasn’t enough. I would soon learn the harsh reality of college debt. The grants I received covered tuition only, so I took out loans to pay for books and a computer. Traveling back and forth from work to school via public transit added to the expense. I kept telling myself that the sacrifices and diligent work would pay off.

I graduated with high honors in May 2018 and earned a Bachelor of Arts degree specializing in Creative Writing. As a bonus, I had gotten some valuable experience as a journalist while in school. I started my journalism career as a contributing writer and editor-in-chief for my college newspaper during the last two years of my undergraduate program.

The momentum inspired me to finish five chapters of a young adult novel I had started in my senior thesis class. I’d received numerous awards for my achievements as a creative writer and as an investigative journalist, and that recognition boosted my confidence.

I thought I had learned all the ins and outs of the journalistic world – but I would get a rude awakening when I started my journey in graduate school.

Starting a new chapter

After I completed my bachelor’s degree, I’d always dreamed of getting my master’s, and also writing a book that spotlighted my talent as a poet and a creative writer. But that wasn’t practical. Somebody once told me that education was a luxury because I had children to support and bills to pay.

I left my full-time job a few months after earning my bachelor’s degree. Besides my desire to pursue my dreams, racism was prevalent during my time at that workplace. I witnessed and experienced countless incidents. With no prospect of promotion and unable to tolerate that hostile work environment any longer, I knew my only option was to resign. I started graduate school full-time soon after. I was thrilled to be chosen for the program. Every step represented another dream come true as I continued my academic journey.

I received a scholarship and thought I had saved enough money to keep me on my feet for a while – or at least until I could land my dream job, perhaps as an investigative reporter at The New York Times, where I aspired to go after getting my master’s degree.

An unexpected detour

My confidence knew no limits. Unfortunately, those days soon ended when I encountered unexpected issues with my courses. After finishing my first semester, I was informed that I would be dismissed due to my low grade point average. I appealed the decision, but I was told by the dean, “The determination is final. There is no process for a further appeal.” That meant I no longer qualified for a scholarship and I also had to rethink my life plans.

I had exhausted a chunk of my funds, while also getting into more debt buying an Apple laptop and other devices the graduate school required all students to have. The traveling, the researching, the interviews, the no sleep, and coming home at 1:00 a.m. All these temporary hardships and sacrifices were a small price to pay if I was to achieve my goals, achieve my dreams, and ensure my family’s financial future. The last thing I expected was to lose all that with their decision.

Grad school was a significant step toward my career in investigative journalism, which everyone had encouraged me to pursue. My main goal is to represent my community and inspire young women of color.

But now I had to focus on finding a job that paid the bills. I worked for a debt settlement company for a few months until March 2020, when the pandemic hit. My writing career was kept afloat by my Community Change fellowship and my resilience despite the circumstances.

I could still write – but that didn’t change the fact that I was over my head in student debt. As a result of the recent Supreme Court decision, I now must accept the reality that I may be in this debt for decades to come.

Pursuing the American Dream at a high cost

For years, people have told me that pursuing an education would give me a chance at achieving the American Dream. Low-income students are told they can get an education if they work hard enough, but they are never told how expensive it will be or how taking on debt will impact their lives.

It may be unlikely that widespread student loan forgiveness will occur soon, but other options could benefit college students. Programs like the Excelsior Scholarship Program in New York now offer students free programs to help with college costs. Lawmakers like Senator Elizabeth Warren have proposed free public college for all Americans.

Despite the government not yet providing relief, I still have hope. President Biden continues to advocate for programs that help alleviate some of the stress associated with student debt.

Being debt-free would be a heavy weight lifted off my shoulders. These initiatives could allow me to achieve my goal of becoming a lead investigative journalist. It would also be a chance to release my sci-fi novel about a young man growing up in the South Bronx and how he turned his passion for writing into his only outlet.

I remain hopeful that initiatives being championed by lawmakers who understand and empathize with those burdened by student debt – and organizations advocating on their behalf – might still someday give me the opportunity to realize my version of the American Dream.

For now, I’ll employ what financial gymnastics I can to prepare for the October payments, like millions of my peers across the country.